When does Ownership Still Win?

Over the past 18 months there has been a clear shift in how occupational therapists, funding coordinators and end-users think about assistive technology: not just “to own or not to own,” but “how long, and under what conditions, before we decide.”

In particular, rent-to-buy models — where equipment is hired short-term and then converted to ownership with a top-up — are showing up more frequently in enquiries. For Shower Access, a specialist AT supplier operating in this space, NDIS enquiries are the largest share of this trend, and it’s shaping the way they frame solutions, write quotes, and talk to funders.

This issue explores:

- Why hire/rental options are gaining traction

- What “rent-to-buy” means in AT practice

- Funding logic under NDIS and other pathways

- When ownership still makes more sense

- How OTs can document and guide these decisions

The Growing Interest in Hire & Rent-to-Buy

Traditionally, assistive technology has been funded as an outright purchase, particularly for long-term needs. But in recent years, suppliers and clinicians are seeing more enquiries for short-term hire or rental, with an option to own later — especially in bathroom access and shower transfer equipment.

Several factors are driving this:

1. Clinicians & Clients Want to De-Risk Decisions

When a person’s function, home context or support network is in flux, committing to an expensive purchase up front can feel risky. A 12-week rental that can convert to ownership gives:

- Time to assess suitability

- Confidence in chosen specification

- A structured review point before long-term investment

This aligns with familiar practice: trial seating, trial wheelchairs, trial mobility scooters — so why shouldn’t bathroom transfer equipment follow the same logic?

2. NDIS Explicitly Supports Flexible Access

The NDIS Assistive Technology policy recognises that equipment may be provided through:

- Rental

- Loan

- Subscription

- Private purchase

- Other commercial arrangements

This flexibility is intentional: to ensure participants access the right solution at the right time, and not simply the cheapest or most familiar option. Rental and rent-to-buy arrangements can be a legitimate pathway under reasonable and necessary criteria, particularly when the participant’s needs are changing or uncertain.

3. Funding Pathways Can Be Easier for Short-Term Hire

Many planners, Local Area Coordinators and support coordinators find it simpler to authorise hire for short periods (e.g. 8–12 weeks) to eliminate immediate risk, rather than signing off an outright purchase when the full clinical picture is still evolving.

For example, where a participant presents with:

- Frailty with potential progression

- Recent hospital discharge

- Variable balance or functional change

- Uncertainty about bathroom layout suitability

…a short-term hire can be approved without requiring a fully settled long-term plan. This decreases the time to risk reduction — the period when falls and carer injury risk are highest.

What Rent-to-Buy Actually Means in Practice

A rent-to-buy path typically works like this:

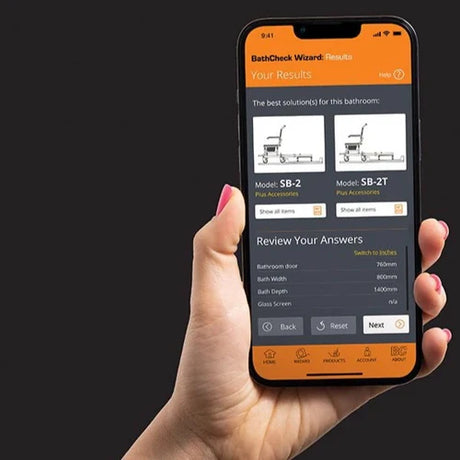

- Assessment & justification — clinician documents immediate risk and rationale for hire, requests home trial

- Hire period — equipment is delivered and used for a defined time (commonly 8–12 weeks)

- Review point — OT re-assesses fit, function and outcomes

- Conversion — if the equipment is right, the hire is credited toward purchase with a top-up payment

The 12-week period has emerged as common because it balances time for trial with manageable hire risk and aligns with typical clearing/booking cycles.

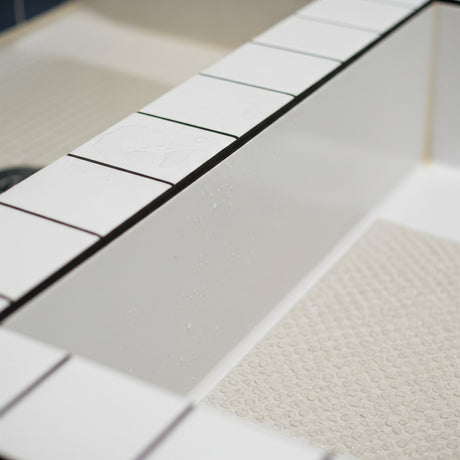

A home visit with access equipment brought to the home offers a more personal experience compared to finding a solution in-store.

When Ownership Still Wins

Rent-to-buy isn’t always the right path. Outright ownership still makes sense where:

- The participant’s needs are stable and unlikely to change

- The solution is unambiguous clinically

- Funding is otherwise straightforward

- Long-term cost over hire would exceed purchase plus top-up

The key is not whether to rent or buy — it’s whether the choice supports safety, value and participant confidence.

Funding Logic Under NDIS & Other Pathways

NDIS

NDIS supports a range of acquisition methods, including rental and loan arrangements, so long as they are reasonable and necessary. Short-term hire can often be authorised quickly to reduce risk, and if the outcome is positive, that investment can flow into a longer-term solution.

Support at Home / Aged Care

Similar flexibility exists under aged-care assistive technology schemes, where purchase, rental or loan are all options depending on need duration, environment and clinical justification.

Why Some Funders Prefer Hire First

Simply put:

- Short-term hire gets equipment on site faster — reduces risk sooner

- Hire avoids premature expenditure if the clinical specification changes

- Review built into the hire model encourages structured re-assessment

This doesn’t make hire inherently better — but it does make it pragmatically easier in many situations.

How to Document & Justify Hire or Rent-to-Buy in Practice

Clear clinical reasoning makes all the difference in faster approvals.

Key documentation prompts:

- Immediate risk and why delay in intervention increases risk

- Why short-term hire is appropriate (uncertainty, trial needs)

- Defined review point (no later than 10–12 weeks)

- Outcome criteria for conversion to purchase

For example:

“Participant demonstrates inconsistent balance and functional fluctuation; immediate risk of falls. A short-term rental of a seated transfer system is required to mitigate risk while participant’s functional trajectory is clarified. Review at 10 weeks will determine need for conversion to purchase.”

This frames the hire as risk management and evidence gathering, not indecision.

What This Means for You & Your Practice

As rent-to-buy becomes a more common pathway, consider:

- Developing standardised hire review checkpoints

- Incorporating conversion language into letters of support

- Educating funders on the trial outcomes approach

- Building internal procedures for rent-to-buy options

Funding Logic Under NDIS & Other Pathways

NDIS

NDIS supports a range of acquisition methods, including rental and loan arrangements, so long as they are reasonable and necessary. Short-term hire can often be authorised quickly to reduce risk, and if the outcome is positive, that investment can flow into a longer-term solution.

Support at Home / Aged Care

Similar flexibility exists under aged-care assistive technology schemes, where purchase, rental or loan are all options depending on need duration, environment and clinical justification.

Why Some Funders Prefer Hire First

Simply put:

- Short-term hire gets equipment on site faster — reduces risk sooner

- Hire avoids premature expenditure if the clinical specification changes

- Review built into the hire model encourages structured re-assessment

This doesn’t make hire inherently better — but it does make it pragmatically easier in many situations.

How to Document & Justify Hire or Rent-to-Buy in Practice

Clear clinical reasoning makes all the difference in faster approvals.

Key documentation prompts:

- Immediate risk and why delay in intervention increases risk

- Why short-term hire is appropriate (uncertainty, trial needs)

- Defined review point (no later than 10–12 weeks)

- Outcome criteria for conversion to purchase

For example:

“Participant demonstrates inconsistent balance and functional fluctuation; immediate risk of falls. A short-term rental of a seated transfer system is required to mitigate risk while participant’s functional trajectory is clarified. Review at 10 weeks will determine need for conversion to purchase.”

This frames the hire as risk management and evidence gathering, not indecision.

What This Means for You & Your Practice

As rent-to-buy becomes a more common pathway, consider:

- Developing standardised hire review checkpoints

- Incorporating conversion language into letters of support

- Educating funders on the trial outcomes approach

- Building internal procedures for rent-to-buy options

Shower Access, one of the specialists in bathroom access equipment, with expert knowledge of Showerbuddy solutions, is positioning rent-to-buy as a standard option because it:

- Aligns with OT reasoning

- Meets participant comfort with risk

- Speaks to funding bodies’ logic

- Reduces return/rework cycles

And they will be unpacking this theme further at the ATSA Expo, May 2026.

To wrap up

Hire and rent-to-buy aren’t new concepts — but they are gaining prominence because they fit real world complexity: variable function, varied home environments, and funding systems that reward evidence-based risk mitigation.

By understanding both the logic and the documentation pathways, clinicians and suppliers can work together to deliver safer, better-informed outcomes — whether the final acquisition is hire, hire-to-own, or purchase.

Hire / Rent-to-Buy vs Outright Purchase

Choosing the Right Assistive Technology Pathway

This comparison is designed to support clinical reasoning, funding justification, and participant conversations where the most appropriate acquisition pathway is not immediately clear.

When Hire / Rent-to-Buy Is Clinically Appropriate

Hire or rent-to-buy is often the preferred initial pathway when:

- The participant’s functional status is variable or deteriorating

- There has been recent hospital discharge

- The home environment suitability is uncertain

- The equipment specification needs confirmation in situ

- Immediate risk reduction is required while funding decisions progress

Clinical framing:

“Short-term hire allows risk to be reduced immediately while confirming long-term suitability.”

When Outright Purchase Is the Better Option

Outright purchase is generally appropriate when:

- The participant’s needs are stable and well-understood

- The environment is known and unchanged

- The equipment will be used daily over the long term

- Funding certainty exists

- Repeated hire would exceed purchase cost

Clinical framing:

“Long-term ownership represents better value for money where needs are stable.”

The Role of Rent-to-Buy

Rent-to-buy bridges the gap between the two pathways.

It allows:

- Immediate access via hire

- Structured review (typically at 8–10 weeks)

- Conversion to ownership with hire credited toward purchase

This approach supports:

- Better specification accuracy

- Reduced returns and rework

- Greater participant and funder confidence

Funding Lens (NDIS & Aged Care)

Funding schemes increasingly recognise:

- Rental, loan and subscription models

- Trial-before-purchase logic

- Interim supports to mitigate immediate risk

The decision is not hire versus purchase, but what pathway best meets reasonable, necessary, and value-for-money principles at that point in time.

Download your copy of the “OT Decision Tree” on this link…

Key Takeaway for OTs

The question to ask is not:

“Should this be hired or purchased?”

But:

“What pathway best reduces risk now, while supporting the right long-term outcome?”

Thank you for reading Access Insights.

My goal is to support therapists, and help clients stay safe at home — without the delays and confusion the system often creates. In researching this article and developing some images I also use AI.

Thank you for supporting Showerbuddy, the whole team is there to help you.

Barry Redican CEO — Showerbuddy

Contact us for any assistance … admin@shower-buddy.com

Safe access. Smart design. Real independence.

#NDIS #SupportAtHome #OT #Showerbuddy #AssistiveTechnology #AgedCare #BathroomSafety

![Toilet Training A Young Child With Mobility Challenges [And How A Shower Chair Can Help]](http://shower-buddy.com/cdn/shop/articles/toilet-training-disabled-child_520x500_a90e5234-d372-435d-aa56-8da15dd3836c.webp?v=1722557239&width=460)